Recurring revenue products – why you need to build recurring income streams

Let’s look at recurring revenue products and why I love this type of product so much. One of the first things I look for when I talk to someone about their business is – do they have recurring revenue? And do they have scalable recurring revenue products?

I love recurring revenue because it means you continually have money coming into the business from the same customers, which gives you more secure cash flow.

How Ahmed made decisions based on ARR targets

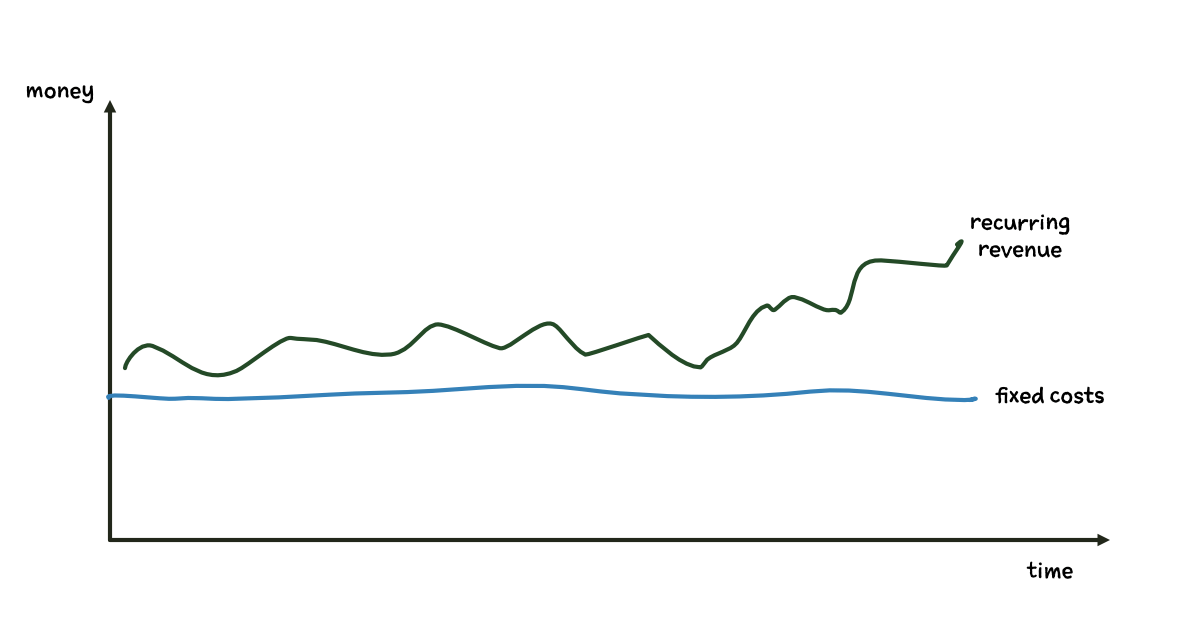

Once upon a time, I worked with a lovely client… let’s call him Ahmed. Ahmed set a clear target: he wanted his recurring revenue to cover his fixed costs.

He prioritised selling his recurring revenue products for a few months to meet this target. He soon got to the point where he knew that he could afford to pay his team, the office rent and his own basic salary, all from recurring revenue.

This was important to him because he wanted a secure foundation for the business. He had all kinds of new ideas for new products and exciting marketing plans. But he was a cautious chap and knew that he could only put these plans into action if he felt confident enough.

Funnily enough, once he’d reached this level of recurring income and could feel confident about the future, all kinds of good things happened for him.

He was happily working on phase two, the more complicated new ideas and these ended up becoming just as profitable for him. He could then pay himself some nice dividends from these profits.

At the same time, he got together with a new girlfriend after being single for a long time. They were both car and motorbike enthusiasts, so he’d tell me of their weekend adventures, test-driving vintage Jaguars. And then he got a contract for some thrilling work involving leaning out of a plane filming wild animals in Nambia.

I believe that all these marvellous causes for celebration in my Ahmed’s life came about at least partly because he had that confidence from knowing he could pause, experiment and be open to new challenges. It wasn’t some vague confidence based on his gut feeling or “manifesting his abundance”. It was based on a reasonable expectation based on his management accounts and calculating his monthly recurring income. The latter tends to give a firmer basis for decision-making, I find.

Which is one of the reasons I’m such a fan of recurring revenue. It’s not just a route to confidence, new partners and wild adventures, though. Let me show you how you can combine recurring income and productising.

Ahmed’s recurring revenue product story in video

Types of recurring revenue product

Your recurring revenue might come from stand-alone products that don’t require much time input.

Examples of recurring revenue stand-alone products that do well

My Product Lift-Off! group for people who want to work together on marketing their products is one way I create recurring revenue here at Adventures in Products. This is the third version of this recurring revenue business model I’ve used, so you can see that it’s working well for me.

A simple example of a recurring revenue product

Michael Simmons is building recurring revenue from his brilliant and thought-provoking Substack newsletter, which I look forward to receiving twice a week. I’m happy to pay for Michael’s thoughts, he loves writing it, and he’s rapidly gathered hundreds of paid subscribers.

Recurring revenue services

The easiest, most straightforward way to build recurring revenue in your services business is to build in booking people again as part of your process of working with them.

Let’s imagine your service business is based on specialist consultancy in social media strategy. Instead of doing one project for a client and then forgetting about them to move on to the next client, you book your client in again for another piece of work next year. Or for a follow-up session in six months. Or both.

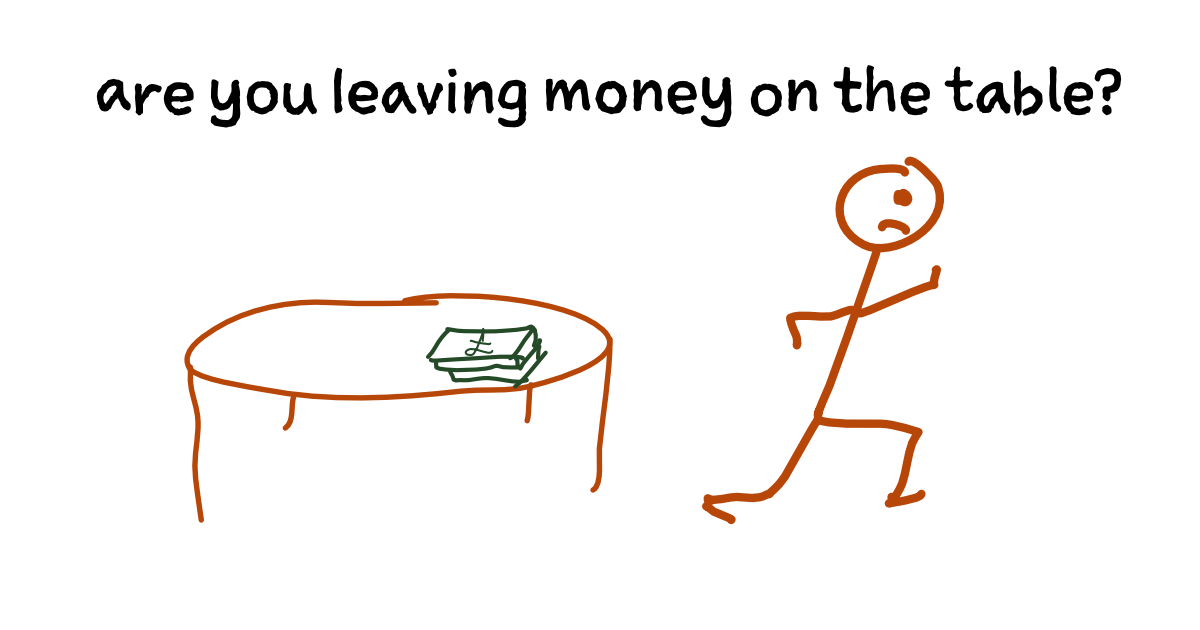

This works for a lot of coaching, consultancy and training businesses. I’m constantly surprised how few people do this, and it distresses me how many business owners leave money on the table.

Go one better with productised services

I also see people leaving money on the table because they haven’t productised their services. When I talk to people about the potential increases in profit with productised services (where you streamline and simplify your services into a product), this goes hand in hand with identifying the potential for building recurring revenue in this part of your product ecosystem.

I did this for years with my business coaching, and this is what my client Ahmed did in phase two of his growth plans.

I can’t tell you about Ahmed’s business in any more detail here, just in case I tell you enough to work out what his real name is. But I can be fully transparent about what was behind my business coaching productised service with a recurring revenue business model.

How I productised my business coaching all those years ago

To be honest, I did this entirely by accident. When I started business coaching way back in 2001, there weren’t many coaches around, so I just copied the way some guy in Australia was working. I set it up so that each client had two sessions per month, with email and phone support in between sessions, to be billed each month in arrears. Simple. Later on, I found out that this was called a productised service.

Anyone who wanted something different got told the truth. And the truth was that it wasn’t cost-effective to pay me to be their ops director or finance director, so I’d help them find someone who would be better and cheaper. And that they needed to see me twice a month because otherwise, we’d spend the whole of our one meeting a month on catch-up. I omitted the other part of the truth: I don’t like doing consultancy timesheets or spending sizable chunks of my time on one client when there are so many other fascinating clients.

Of course, it sounds simple to say this now, but I should point out that again, I didn’t entirely know what I was doing when I first got going, so I learnt these lessons after agreeing to do these bespoke extras and then finding out that this wasn’t the best way for the clients or for me.

How recurring revenue changed my business

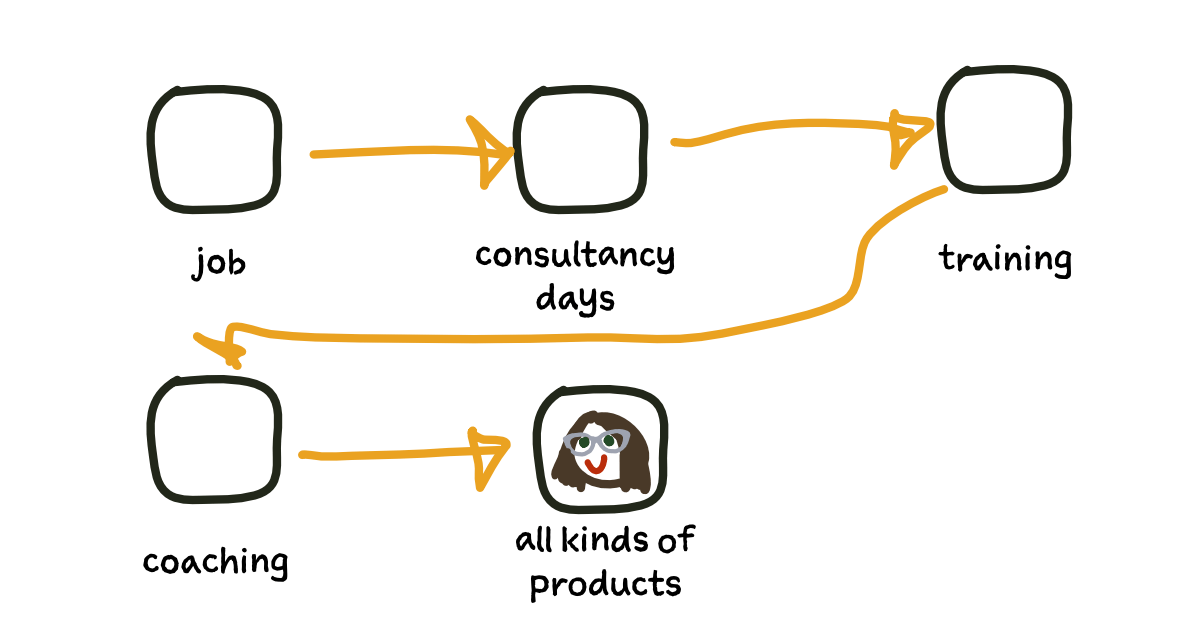

I went from selling consultancy projects to selling training days to selling business coaching as a recurring revenue productised service.

The change was enormous. In my previous self-employed incarnations, I was always worried about where the next project was coming from – I had “feast or famine” anxiety a lot of the time. This time around, I knew that whatever I was billing this month, I’d probably have the same for the next few months. And this gave me a solid foundation to build my marketing machine and develop my business further. Plus, I had enough recurring income to allocate two days a week for marketing and developing products. Plus not work on Monday mornings unless I wanted to.

How recurring revenue products lead to financial security

The business model most people use when they first set up in business involves trading time for money. We sell a chunk of our time to perform a service and get paid in return. This is the billable hours business model, although I’ve called it the prostitute business model before now. We don’t even think about recurring revenue products when we’re first getting going.

I’m sure you can see why.

I think we’re trained to do this because all around us, people are selling their time for money in their regular jobs. And, most of us start a business after we’ve had a regular job for some time.

But there’s a reason why we left that job. And why we don’t want another job. And we definitely don’t want a whole bunch of mini-jobs with a bunch of bosses we call clients. We want to be the boss, to be our own boss.

And, of course, when we sell a chunk of time for money, that money is soon gone. It doesn’t come back – unless you have recurring revenue products.

Now I’ve persuaded you that recurring revenue products are a good idea, let’s look at how this works with products for your double whammy of scalability.

Double whammy – recurring revenue with products

Financial security doesn’t just come from knowing you will have money coming in next month and the month after. Financial security also comes from having more money.

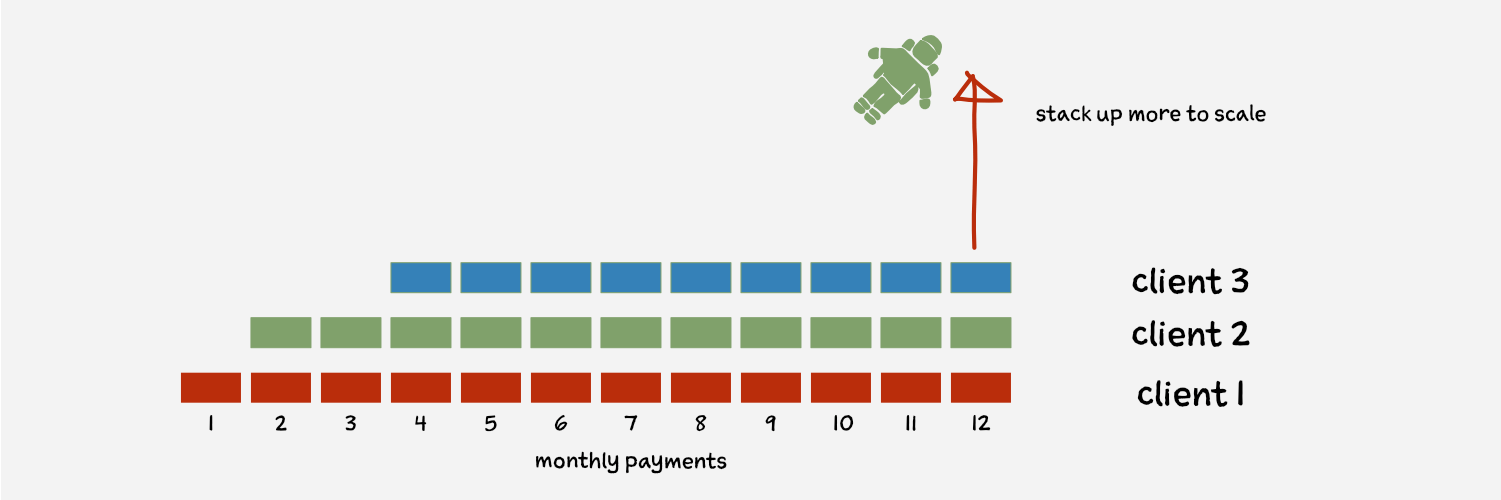

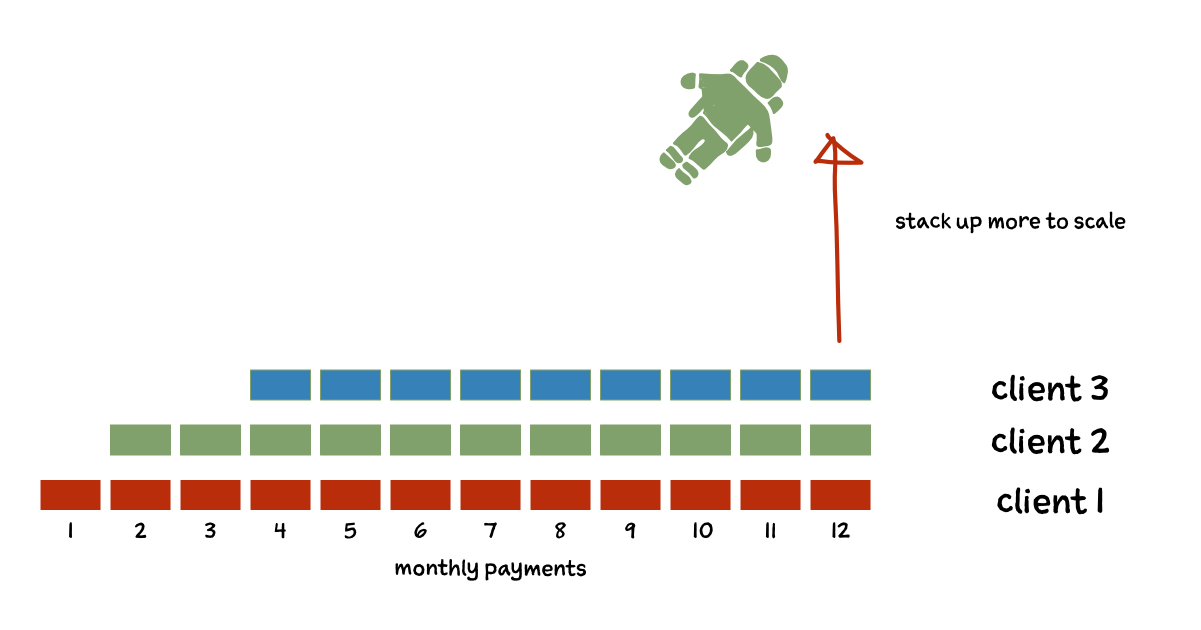

Recurring revenue products give you these chunks of money coming in each month. The clever part is where you start to stack your clients, because you’ve productised what you do. You can work with people in groups, simplify how you work with clients so that you can take on more clients or take yourself out of the equation and make it (theoretically) infinitely scalable with 100% stand-alone products.

Want to dig in and pivot to a product-based business right now?

As you’ve probably guessed, I’m a complete geek and mad enthusiast for helping people build product-based businesses. It completely changed my business, and I’ve helped hundreds of companies pivot to products in different ways over the years.

I’ve put everything I wish I’d known all those years ago into my Pivot to Products course. Including a load of ideas for how to get going with recurring revenue products.

I also run a full-on six-month group programme for people who want to get going fast and get support, accountability and top learning from someone who has been there, done it and made all the mistakes and missteps so you don’t have to. Check out when the next Productise Your Expertise group is running.